Need help understanding how Medicare works?

Relax …and yes, you may throw out the mounds of mail you have been receiving! We have 40 Years of Medicare Experience we will explain Medicare and Supplementary coverage choices in simple, understandable terms. We represent all companies and we will provide you with comprehensive, affordable plan choices (some plans cost as little as $0 a month).

Think of us as your no-cost Medicare guide experts that provide you with peace of mind. |

If You are approaching age 65 |

You should contact us, preferably, 90 days in advance of your Medicare effective date. Note: You do not automatically receive Medicare unless you have already elected to receive early Social Security retirement income or were on Medicare due to a Qualified Disability or End Stage Renal Disease.

|

Frequently Asked Questions |

I am turning age 65 in the middle of a month when will my Medicare be effective?

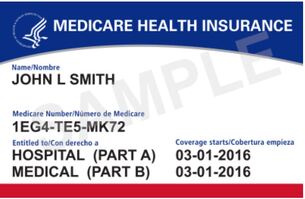

Your Medicare will be effective the 1st of the month you turn age 65 (unless you were born on the 1st, then your Medicare is effective the 1st of the of the month prior to you turning age 65) Once I have Medicare Parts A & B, what do I need to do? Once you have Part A and Part B, you are then eligible to enroll in a Medicare Supplement plan and Part D Prescription Coverage plan, or conversely, a combined all-in-one Medicare Advantage (Part C) MAPD plan that includes Part D (prescription drug) plan. I have employer coverage and do not plan to retire until past age 65; what shall I do? Signing up for Medicare Part B is voluntary, but you may face a penalty for late enrollment if you do not sign up it when you turn 65, unless you or your spouse are still working and have a creditable group health plan from the employer. COBRA does not count as creditable coverage for the purposes of alleviating the late enrollment penalty. Similarly, Part D is voluntary, but you may face a penalty for late enrollment if you sign up for a Part D plan after your initial enrollment period ends and you go for more than 63 days without a source of “Creditable” drug coverage that at least as good as what Medicare Part D offers. Check with your employer to see if they require you to sign up for Medicare Parts A & B and whether your prescription drug coverage is deemed “creditable” by Medicare standards I have employer coverage and plan to retire in a couple of months; what shall I do? You can sign up anytime while you (or your spouse) are still working and you have health insurance through that employer. You also have 8 months after you (or your spouse) stop working to sign up. It takes time to process special enrollments, so you should apply a minimum of 90 days in advance of your retirement date. if not more.

Even if you have a Special Enrollment Period to join a plan after you first get Medicare, you might have to pay the Part D late enrollment penalty. To avoid the Part D late enrollment penalty, don’t go 63 days or more in a row without Medicare drug coverage or other creditable drug coverage (COBRA coverage does not count as creditable coverage). |